Estimate payroll taxes 2023

Second Quarter Fiscal 2023 Total Revenue of 3037 million up 53 Year-over-Year. Projected revenue from payroll taxes and income taxes on OASDI benefits credited to the HI Trust Fund increases from 15 percent of GDP in 2022 to 18 percent in 2096.

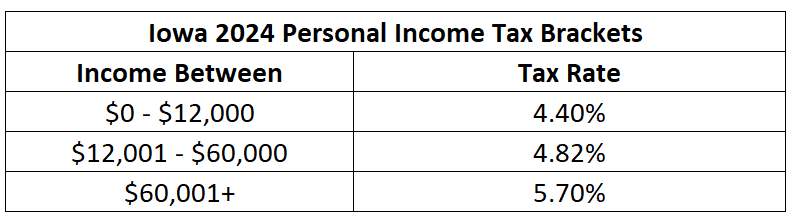

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

To estimate your deduction use the payroll deduction calculator.

. 2022 Payroll Deduction Calculator 2023 Payroll Deduction Calculator. An estimate of the wages you earned for the tax year and the federal income tax withheld 3. Launch Resource Center.

But are projected to become larger after 2023 due to higher projected provider payment updates. Call the Internal Revenue Service IRS at 800 829-1040 if you do not receive your W-2 by February 14th. While we estimate that the provision raises 203 billion over the next decade this may be an upper bound as.

Also the contribution of foreign trade was. It had originally closed applications on August 8 2020 but. President Bidens Tax Proposals.

Taxes you file in 2023 with our tax calculator by answering simple questions about your life and income. Reporting employee contributions on tax Form W-2 using Box 14 State disability insurance taxes withheld. Cap Figure Base Salary Likely Incent.

Estimate Salary Paychecks After Required Tax Deductions. This calculator is for 2022 Tax Returns due in 2023. Jul 20 2022 JaMychal Green Waived by Oklahoma City.

The expenses you pay with an EIDL advance are also fully tax deductible for federal taxes. View The Income Tax FAQ. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll.

Estimate your tax refund or how much you may owe to the IRS with TaxCaster our free tax calculator that stays up to date on the latest tax laws so you can be confident in the calculations. The Mississippi State Personnel Board is the human resources management agency for State government and we are committed to ensuring a quality workforce for the State of Mississippi. Trade Bonus Cap Figure Cap Cash Remaining.

Start filing your tax return now. Free 2022 Employee Payroll Deductions Calculator. Referred client must have taxes prepared by 4102018.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. MongoDB Atlas Revenue up 73. The trust fund draws its money from payroll taxes paid by businesses.

Continued Strong Customer Growth with Over 37000 Customers as of July 31 2022. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an HR Block or Block Advisors office and paid for that tax preparation. Household consumption rebounded 03 vs -12 in Q1 especially in accommodation and food services 134 vs -26 as covid restrictions were lifted and better than a 02 decline initially reported.

The largest revenue raiser is the 15 percent minimum tax on corporate book income for corporations with average annual adjusted financial statement income that exceeds 1 billion for any three consecutive tax years beginning in 2023. The payroll tax rate reverted to 545 on 1 July 2022. For the first time lots of sole proprietors independent contractors and freelancers will start receiving 1099-Ks in January 2023.

Estimate your income tax burden with as much or as little detail as youd like and start planning ahead for April. The Biden administrations proposed American Jobs Plan AJP American Families Plan AFP and fiscal year 2022 budget would increase federal spending by about 4 trillion over 10 years including 17 trillion for infrastructure partially funded with higher taxes on individuals and businesses. Impact on trust funds likely minimal Social Security is funded by a payroll tax of 124 percent on eligible wages employees and employers each pay 62 percent.

But instead of integrating that into a general. Self-employed people pay both sharesThe maximum amount of work income subject to the Social Security tax is currently 147000 a number that will be adjusted for wage increases in 2023. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

Previously it only applied to businesses that made over. The French economy expanded 05 on quarter in Q2 2022 recovering from a 02 decline in Q1 and matching a preliminary estimate. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. Referring client will receive a 20 gift card for each valid new client referred limit two. OKC - includes 2023-24 Club Option.

Filing Quarterly Estimated Taxes. The payroll tax rate reverted to 545 on 1 July 2022. CBOs estimate of the deficit for 2020 is now 8 billion moreand its projection of the cumulative deficit over the 20202029 period 160 billion morethan the agency projected in August 2019.

I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. If your employer still has not sent you your W-2 by February 14th you will need to contact the IRS. Private health plan assumptions07.

An estimate from. The rules now apply to any total revenue thats over 600. Social Security.

See Joint Committee on Taxation Estimates of Federal Tax Expenditures for Fiscal Years 20192023 JCX-55-19 December. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. E-File With Income Tax Software.

There are certain instances where an employee may qualify to be exempt from federal taxes however there are strict parameters for qualification of exemption and it is strongly recommended that advice is sought from a tax professional. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Paycheck Protection Program PPP The Paycheck Protection Program offers loans to small businesses to keep employees on payroll and cover certain other expenses during the coronavirus pandemic.

Jul 26 2022 Sacha Killeya-Jones Signed a contract with Oklahoma City OKC - Exhibit 10. The new rate that takes effect in 2023 is currently the lowest possible rate on an eight-tier scale.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The Inflation Reduction Act Won T Affect Most Americans Tax Bill

State Corporate Income Tax Rates And Brackets Tax Foundation

Biden Budget Biden Tax Increases Details Analysis

Tax Year 2023 January December 2023 Plan Your Taxes

2022 2023 Tax Brackets Rates For Each Income Level

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Property Tax City Of Paducah

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

2022 2023 Nys Budget Bill Legislation Includes Significant Changes For Ptet Grossman St Amour Cpas Pllc

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

New York State Enacts Tax Increases In Budget Grant Thornton

Social Security What Is The Wage Base For 2023 Gobankingrates

2022 2023 Salary Cap Issues How Much Is Joe L Willing To Pay R Warriors

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company